In 1973, management guru, Peter Drucker wrote that the purpose of a business is “to create a customer”. Said another way, no matter what business you are in, you work for a customer. Now, fifty years later, we talk about the importance of the client experience in the wealth and investment business. Yet, as an industry, we often focus more on the needs of the business and meeting business goals, than on what’s important to our clients and prospects. In other words, we’re making it about us and not them (against which Mr. Eastwood also advised.)

Today’s clients are accustomed to choice and have no qualms about leaving a service provider in search of better options or a better experience. Considering the highly competitive nature of the financial services industry, it would make sense for banks and credit unions to be putting client experience at the top of their priority list.

Yet consider this scenario: You work in the wealth management group at a regional bank. A new prospect is identified by a commercial banker with your firm. The prospect has a $2M discretionary portfolio at another firm, $1.5M self-directed investments with an online brokerage, and $1M irrevocable life insurance trust, and their family business is a significant commercial banking relationship with your firm. The trust advisor believes the relationship should be an investment management and trust relationship because of the ILIT and the discretionary account on the fiduciary platform at the prospect’s current firm. The financial advisor is certain this is a brokerage prospect because he will do a much better job with the relationship than the trust advisor. The planning and insurance specialist believes both her colleagues are wrong because only a planner can be unbiased. The commercial banking manager has made it unquestionably clear that she doesn’t care who is on point, just don’t screw-up the existing business relationship. At this point, debate consumes the three wealth management professionals, their respective managers, and an H.R. specialist called in to help evaluate alternative approaches to allocating incentive compensation.

Sound familiar? What’s wrong with this picture? The bank lost sight of what should matter most: the client. If you’ve been in this business for any length of time, it’s likely you’ve experienced some variation of this scenario. Unfortunately, the root cause is lack of clarity about who we serve and how we serve them.

In contrast, when a firm’s go-to-market operating model starts with the client (think Drucker), and a clearly defined client experience roadmap, the dynamic changes. Like having a script and choreography for a Broadway play, wealth management professionals deliver a much stronger performance when their moves are planned in advance, regardless of which role they play. The emphasis is on the client, what they get from the firm (keeping in mind investment performance and fees are not the only answers), and how each character in the cast collaborates to deliver a seamless experience.

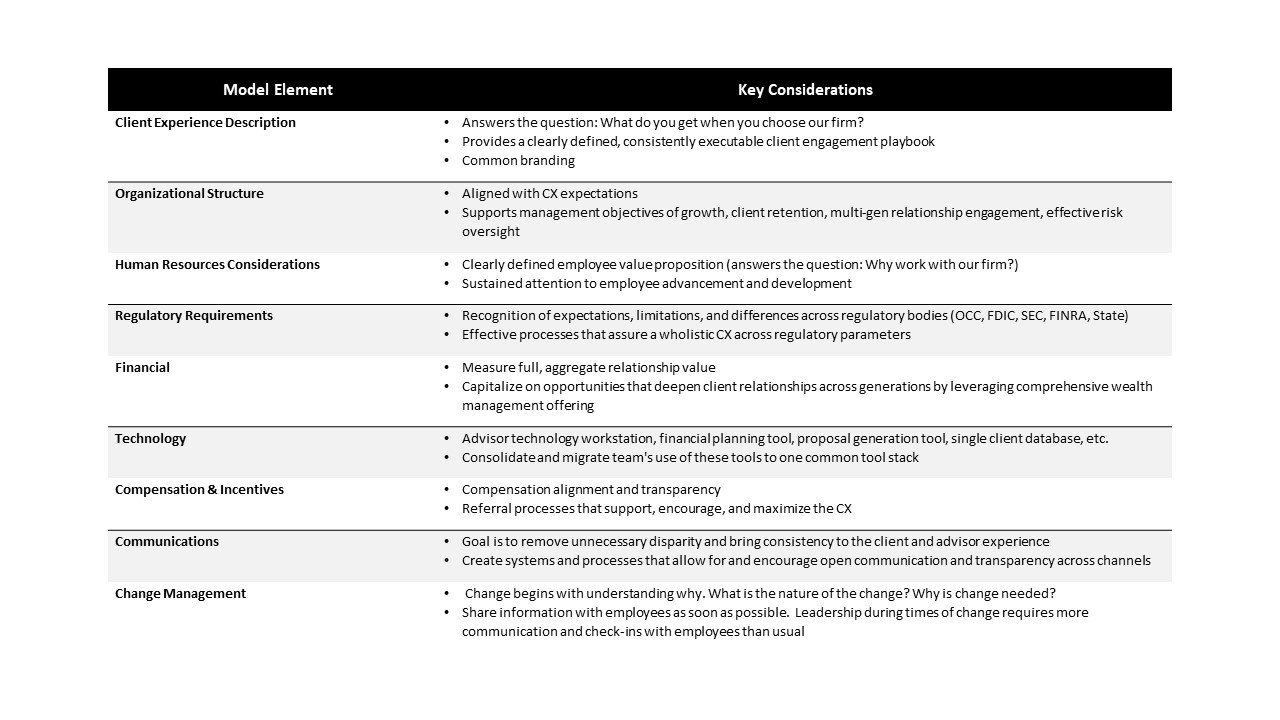

Let’s take a closer look at common elements in a client-centric go to market model.

Where to Begin?

An essential first step in the journey to a client-centric, unified delivery go-to-market model is defining the client experience. Not the brokerage, trust, insurance, private banking experience; THE client experience – a single, seamless engagement approach designed around understanding needs, expectations, current reality and anticipated future state of a client’s financial life. The client experience roadmap then informs subsequent design and implementation steps.

What’s Next?

There continues to be significant opportunity for the collective wealth management businesses in financial institutions to enhance the client experience. However, the wealth unification journey is – no doubt – a significant undertaking. The good news is you don’t have to do it alone.

The Bielan Group and partner firm, Strategic Advisory Consulting Group, have helped many firms successfully navigate the unification journey. We can help you with any and/or all phases of the journey – from developing your roadmap to outlining critical considerations, identifying key stakeholders, creating your plan, and guiding you through successful implementation.

If you’re considering moving to a more unified, client-centric model, reach out to us to schedule a brief discovery call today. We’re here to help.

The Bielan Group

The Bielan Group provides the wealth management industry with the experience and resources to help firms make more informed decisions and enhance business performance.

Drawing on 35 years of identifying ‘best in class ‘partners within the industry, The Bielan Group assembles the right team of resources for each individual client to best meet their specialized needs and objectives.

The firm’s founder, Peter Bielan, has been a leader in the financial institution-based financial advice community since 1985. His roles have encompassed advisor, sales manager, president of the retail broker/dealer for two of the 15 largest U.S. banks, and partner at Kehrer Bielan Research & Consulting.

Throughout his career, Peter has dedicated his efforts to profitably growing sales, developing the infrastructure needed for expansion, and leveraging the partnership between investment services and the other departments within the institution.

Strategic Advisory Consulting Group

Strategic Advisory Consulting Group helps organizations earn and sustain relevance with their stakeholders.

Dave Coffaro, Principal of the Strategic Advisory Consulting Group, has been actively involved in the financial services industry a consultant, practitioner, and executive for more than 30 years.

Dave’s strategy consulting work began in graduate school, evolving into engagements with financial services firms and franchisors. He transitioned into wealth management roles with Bank of America and served as EVP, Chief Fiduciary Officer and Head of Trust & Fiduciary Services with Wells Fargo.

Dave is committed to enhancing professional competency in organizations. In the banking industry, he furthered this mission as Founding Chair of the UC Berkeley Extension Wealth Management Program, served on the American Bankers Association Professional Development Council and through the Trust Management Association.